Taxpayers Stimulus Checks: A Comprehensive Guide

In recent years, stimulus checks have become a hot topic of discussion among taxpayers, policymakers, and economists alike. Taxpayers Stimulus Checks These payments, often issued by the government during times of economic hardship, are designed to provide financial relief to individuals and families. For taxpayers, stimulus checks can be a lifeline, helping to cover essential expenses, boost consumer spending, and stimulate the economy. In this article, we’ll dive deep into the world of taxpayers’ stimulus checks, exploring their purpose, eligibility criteria, impact, and much more.

What Are Taxpayers Stimulus Checks?

Taxpayers stimulus checks are direct payments issued by the government to eligible individuals and families. These payments are typically part of broader economic relief packages aimed at addressing financial challenges, such as recessions, pandemics, or other crises. The idea behind stimulus checks is simple: by putting money directly into the hands of taxpayers, the government can encourage spending, support struggling households, and jumpstart economic growth.

Stimulus checks are not a new concept. They have been used in various forms throughout history, particularly during times of economic downturn. For example, during the Great Recession of 2008, the U.S. government issued tax rebates to stimulate the economy. More recently, during the COVID-19 pandemic, multiple rounds of stimulus checks were distributed to help Americans cope with the financial fallout of lockdowns and job losses.

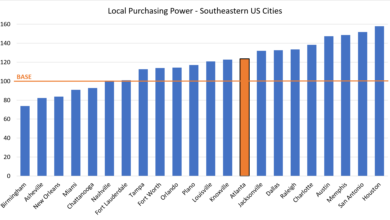

The amount of money distributed through stimulus checks varies depending on the specific relief package and the taxpayer’s financial situation. Typically, these payments are based on factors such as income level, filing status, and the number of dependents. For many taxpayers, stimulus checks provide much-needed relief, allowing them to pay bills, buy groceries, or save for future expenses.

How Do Taxpayers Qualify for Stimulus Checks?

Eligibility for stimulus checks is determined by a set of criteria established by the government. While these criteria can vary depending on the specific relief program, there are some common factors that are often considered.

One of the primary factors is income level. Most stimulus programs set income thresholds to determine who qualifies for payments. For example, during the COVID-19 pandemic, individuals earning up to a certain amount were eligible for the full stimulus payment, while those earning above that threshold received reduced amounts or no payment at all. Taxpayers Stimulus Checks These income limits are typically based on adjusted gross income (AGI) as reported on tax returns.

Filing status also plays a role in determining eligibility. Taxpayers Stimulus Checks Single filers, married couples filing jointly, and heads of household may have different income thresholds and payment amounts. Additionally, the number of dependents can impact the total stimulus payment. In many cases, taxpayers receive additional funds for each qualifying dependent, such as children or other family members they support.

It’s important to note that eligibility criteria can change from one stimulus program to another. Taxpayers Stimulus Checks Taxpayers should stay informed about the latest updates and guidelines to ensure they receive the payments they’re entitled to.

The Impact of Stimulus Checks on Taxpayers

Stimulus checks can have a profound impact on taxpayers, both individually and collectively. On a personal level, these payments can provide immediate financial relief, helping individuals and families cover essential expenses such as rent, utilities, and groceries. Taxpayers Stimulus Checks For many, stimulus checks are a lifeline during times of economic uncertainty.

Beyond individual benefits, stimulus checks also play a crucial role in stimulating the broader economy. When taxpayers receive these payments, they are more likely to spend the money on goods and services, which in turn supports businesses and helps create jobs. Taxpayers Stimulus Checks This ripple effect can help boost economic growth and recovery, particularly during periods of recession or crisis.

However, the impact of stimulus checks is not without controversy. Some critics argue that these payments can lead to inflation or increase government debt. Taxpayers Stimulus Checks Others believe that stimulus checks are not a long-term solution to economic challenges and that more comprehensive reforms are needed. Despite these debates, there’s no denying that stimulus checks have provided critical support to millions of taxpayers in times of need.

How Are Stimulus Checks Distributed?

The distribution of stimulus checks is a complex process that involves multiple steps and agencies. Typically, the Internal Revenue Service (IRS) is responsible for issuing these payments, as they have access to taxpayers’ financial information and can determine eligibility based on tax returns.

In most cases, stimulus checks are distributed via direct deposit, paper check, or prepaid debit card. Taxpayers who have provided their bank account information to the IRS typically receive their payments faster through direct deposit. Those who haven’t provided this information may receive a paper check or debit card in the mail, which can take longer to arrive.

The timing of stimulus check distribution can vary depending on the specific relief program and the efficiency of the IRS. During the COVID-19 pandemic, for example, some taxpayers received their payments within weeks, while others experienced delays due to processing issues or outdated information.

To ensure they receive their stimulus checks promptly, taxpayers should make sure their contact and banking information is up to date with the IRS. They can also use tools like the IRS’s “Get My Payment” portal to track the status of their payment.

Common Questions About Taxpayers Stimulus Checks

1. Are stimulus checks taxable?

No, stimulus checks are not considered taxable income. They are treated as tax credits or advance payments of a credit, which means they do not need to be reported as income on your tax return.

2. What if I didn’t receive my stimulus check?

If you believe you are eligible for a stimulus check but did not receive one, you can claim the payment as a Recovery Rebate Credit on your tax return. Be sure to check the eligibility criteria and provide any required documentation.

3. Can I still receive a stimulus check if I haven’t filed my taxes?

Yes, but you may need to file a tax return to provide the IRS with the information they need to determine your eligibility. Non-filers can use the IRS’s Non-Filers tool to submit their information.

4. Will there be more stimulus checks in the future?

The possibility of future stimulus checks depends on economic conditions and government decisions. While there are no guarantees, policymakers may consider additional payments if the economy faces further challenges.

Conclusion

Taxpayers stimulus checks have become a vital tool for providing financial relief and stimulating economic growth during challenging times. Whether you’re a recipient of these payments or simply curious about how they work, understanding the ins and outs of stimulus checks can help you make informed decisions and navigate the complexities of economic relief programs. Taxpayers Stimulus Checks As we look to the future, the role of stimulus checks in supporting taxpayers and the economy will continue to be a topic of discussion and debate.

This article provides a comprehensive overview of taxpayers stimulus checks, covering everything from their purpose and eligibility to their impact and distribution. By staying informed and proactive, taxpayers can ensure they receive the support they need and contribute to a stronger, more resilient economy.